|

||||||||||||||||||||

| For nearly three and a half years, this newsletter has informed readers of SCS technical developments, test results, product applications and, most importantly, user advantages. It's created strong interest among fabricators wanting to try SCS in their operations and many have, in fact, converted over to using SCS.

|

|

|||||||||||||||||||

| Subscribe to SCS UPDATE Read Previous Issues |

||||||||||||||||||||

|

2007 changed that in a big way !

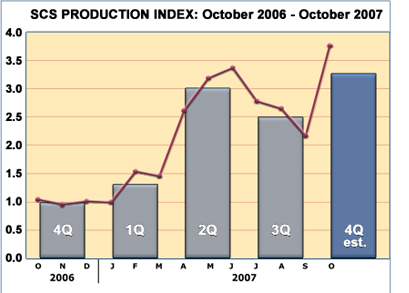

Five new SCS Production Centers entered operation in 2007and have driven SCS tonnage up by a factor of almost four from year-ago levels. Total SCS tonnage processed at all Production Centers has been tracked each month since the 4th quarter of 2006. Taking the average output of those three months as the base of 1.0, the SCS Production Index (the reddish line) has added in the contribution of each new Production Center as it begins shipping SCS. In October, the Index reached 3.75 |

|||||||||||||||||||

JDM Steel (Chicago) – SCS Coil Line in February. Feralloy Corp (Charleston, SC) – SCS Sheet Line in April. Fulton Country Processing (Delta, OH) – SCS Coil Line in June. Central Steel & Wire (Portage, IN) – SCS Sheet Line in September. Adding these 'newcomers' to the three existing SCS Sheet Lines that were already in operation at TMW, Holvoet (Belgium),and Heidtman Steel (Butler, IN) brings the SCS 'Fleet' to five SCS Sheet and three SCS Coil Lines. The increase in SCS production is more impressive when you consider the first-ever SCS Coil Line, located at TMW, was taken out of service at the end of April. “We needed the floor space and much of that line's coil handling equipment to use in the EPS Alpha Line (see" What is EPS ?" below)," explains TMW President Kevin Voges. "The timing of the new SCS Coil Lines in the US was crucial because they filled the void created when our Coil Line stopped production, not to mention the fact that they've brought their own new customers into the SCS fold." |

||||||||||||||||||||

| The upshot of those new customers is already being felt at JDM Steel, where a facility expansion got underway only eight months after their SCS Coil Line entered operation. "We see the need for more coil storage and this addition will bump up our storage capacity by 60%," states JDM Steel President Rich Merlo. "It helps that we can supply SCS in either sheet or coil out of this facility (coils that have been run through the SCS process can be blanked on JDM's cut-to-length line). That gives us a broader, more diverse customer base." A more diverse customer base is fueling much of the growth for all SCS Production Centers. Specifically, OEM accounts like railcar and storage tank manufacturers have converted to SCS from HRPO HR and are now ordering in large volume. In fact, much of the dip in SCS production in the third quarter was a "breather" after orders from multiple large accounts were processed in the April to June period. Reorders from those accounts drove much of October's production spike. “Those spikes and valleys in SCS production will level out soon enough," Merlo explains. "What's important is that on this upward trend we don't find ourselves in another SCS capacity shortage. That would slow the rate of market adoption again." |

||||||||||||||||||||

| Heidtman Steel has been proactive in preventing such a shortage, announcing its second SCS Production Center at its new sheeting facility on the Severcorr mill campus in Columbus, Mississippi. That SCS Sheet Line is expected to enter production in the second half of 2008. Prior to that, Singer Steel of Cleveland, Ohio will start up its SCS Production Center – also an SCS Sheet Line – in January 2008. And finally, a new SCS Coil Line will add capacity to serve the European market. Eric Fritsche, VP of Processing Division at TMW, which operates the original SCS Sheet Line that started up in 2003, explains why he isn't worried about SCS capacity limitations: "Say any of these SCS lines gets close to having their capacity sold out at this time next year. What do they do? They can put another SCS Brushing Machine in series with their current one in the same line. That would be a quick capacity increase of at least 60%. They don't need another destacker, stacker, conveyors and what have you. Just another 15 feet of floor space - that's about it. Oh . . . I guess they'll need a second material handler too. But believe me, no one's gonna complain about having to post that job." |

||||||||||||||||||||

|

||||||||||||||||||||

|

||||||||||||||||||||